Introduction

When it comes to income tax, it's important to understand the various notices and procedures that the Income Tax Department may initiate. One such notice is under Section 142(1) of the Income-tax Act, which empowers the tax authorities to issue an inquiry notice before the assessment of tax. In this comprehensive guide, we will delve into the details of Section 142(1), its purpose, and how to respond to such notices.

Section 142(1) of the Income-tax Act

Section 142(1) of the Income-tax Act, 1961 grants the Income Tax Department the authority to issue a notice to taxpayers seeking clarification or additional details. This notice is typically sent when a taxpayer has not filed their tax return or when further information is required to assess their tax liability accurately.

When is the Notice under Section 142(1) issued?

The Notice under Section 142(1) can be issued in two scenarios. First, when a taxpayer has filed their income tax return under Section 139(1), and second, when a taxpayer has not filed their income tax return under Section 139(1), and the specified time period for filing the return has expired. However, the Assessing Officer can only request the production of accounts or information relating to a period of three years before the previous year.

Purpose of Notice under Section 142(1)

The primary purposes of the Notice under Section 142(1) are as follows:

-

Filing of Income Tax Return: If you have not filed your income tax return within the specified period or before the end of the relevant assessment year, you may receive a Notice under Section 142(1) asking you to file your return promptly.

-

Production of Specific Accounts and Documents: After filing your income tax return, the Assessing Officer may request you to produce specific accounts and documents required for the assessment of your tax liability. These documents can include purchase books, sales books, proofs of deductions, and more.

-

Furnishing Additional Information: The Assessing Officer may also require you to furnish any other information, notes, or workings on specific points as deemed necessary. This information may or may not form part of your books of accounts and can include a statement of your assets and liabilities.

Penalty for Non-Compliance of Section 142(1) Tax Notice

Non-compliance with the Notice under Section 142(1) can lead to various penalties and consequences, including:

-

Imposition of Penalty: If you fail to comply with the Notice, a penalty of Rs 10,000 can be imposed on you under Section 271(1)(b) of the Income-tax Act.

-

Best Judgement Assessment: Your case may fall under the "Best Judgement Assessment" as per Section 144 of the Income-tax Act. The Assessing Officer will assess your tax liability based on their best judgment and the relevant material available to them.

-

Prosecution: Non-compliance can also result in prosecution under Section 276D, which can lead to imprisonment for up to one year and a fine.

-

Search Warrant: In certain cases, the Assessing Officer may issue a warrant under Section 132 for conducting a search.

It is crucial to take these penalties into account and ensure timely compliance with the Notice under Section 142(1).

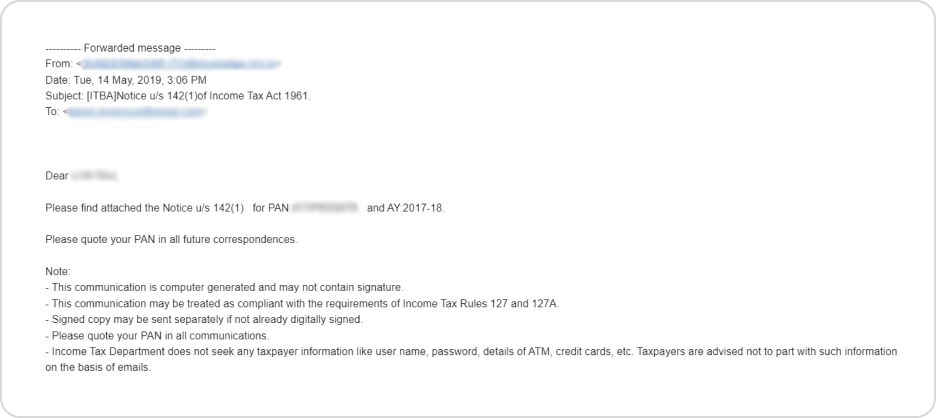

Sample Email of the Notice under Section 142(1)

When you receive a Notice under Section 142(1), you may be required to respond with the necessary information and documents. Here is a sample email format for your reference:

How to Submit a Response to the Notice under Section 142(1)

To submit your response to the Notice under Section 142(1), you can utilize the online 'e-Proceedings' facility available on the Income Tax E-filing portal. Here is a step-by-step guide on how to do so:

-

Log in to the Income Tax E-filing portal www.incometax.gov.in.

-

Navigate to the "Pending Actions" tab and select "E-proceedings."

-

Choose the "View Notices" option to see the details of the Notice under Section 142(1).

-

Click on the "Submit Response" button to proceed.

-

Select the appropriate response type for the notice, either "Partial Response" or "Full Response."

-

Provide the necessary details, documents, and explanations as requested by the Assessing Officer.

-

Review the submitted response and click on the "Submit" button to finalize the submission.

It is important to ensure that all the requested information and documents are accurately provided within the specified time frame.