Order of Utilization of Input Tax Credit Under GST Set Off Rules

The government has changed the procedure of setting-off of set-off starting on the 29th of March 2019. These new regulations were formulated to lower the balance that is under IGST credits in order to optimize how they are distributed between Center along with the government. But, in the event that the mechanism isn't fully understood and off-sets are not optimized, business could be faced with more work capital requirements. Therefore, it is crucial to comprehend the order of use of the input tax credits, how to optimize the tax credit for input and the effect on the business.

Read Also:- DGGI's Special Drive Against Fake Input Tax Credit (ITC)

Latest Updates

1st February 2023

Budget 2023 updates*

- Section 16 has been amended to provide that buyers who do not pay their suppliers the invoice amount and the GST amount within 180 days of the date of on the invoice are required to pay an amount equivalent to the ITC demanded, plus the interest required under Section 50.

- Sections 37, 39, 44 and 52 are modified to prohibit the filing of GSTR-1 and GSTR-3B by taxpayers GSTR-9, and GSTR-8 during a tax period following the expiration of three years after the due date.

- Section 17(5) has been amended to include a second item that is non-eligible ITC that is expenditure for CSR initiatives for corporations.

- Sales at sea and similar transactions neither the supply of goods nor services are exempt from taxation and therefore ITC proportional to these sales is not able to be claimed in accordance with the new Regulation 17(3).

- The Schedule III was revised to add paragraphs (7) as well (8) and an explanation (2) to take retroactive beginning on July 1st, 2017.

- In addition, Section 10 of the CGST Act has been amended to permit companies that sell products through an online retailer to join the scheme of composition.

*The amendments will come into effect after being notified by the CBIC.

The Amended Law on Order of ITC Set-Off

CGST Circular No. 98/17/2019, which was published on April 23, 2019 and clarified the sequence of ITC use for each tax category. In addition, until the rule 88A of the CGST Rules was implemented on the GST portal, taxpayers were required to use the facility through the GST portal until July 2019. The facility became available starting in July 2019 and onwards.

First, let's take a look at the two sections included into the CGST Act-

“Section 49A: In spite of anything by section 49 tax credit for Central tax, State tax, or Union territory tax can be used to pay central tax, integrated tax or State tax, or Union territory tax depending on the situation. be and only after the tax input credit that is available as a result of integrated tax has been used to the fullest extent for such payment.

Section 49B: In addition to anything in the present Chapter as well as subject to the conditions in clause (e) as well as clause (f) of section 49, sub-section (5) of Section 49. government may based on the recommendations of the Council and the Council, determine the sequence and method of use of the tax credit for input for central tax, integrated tax State tax, or Union territory tax depending on the situation and towards the paying any tax."

The rule 88A was added to announce the new provision through CT notification number. 16/2019 dated 29th March 2019.

Rule 88A: Order of utilisation of input tax credit:- Credit for input tax on account of integrated tax should initially be used to pay of integrated tax. Then, the remainder that is not used, may be applied towards the payment of central tax as well as state tax, or tax on the Union territory depending on the situation or in any other decision. In the event that the tax credit for input in respect of central tax or State tax or tax on Union territories may be used to pay central tax, tax integrated or State tax, and Union Territory tax in the event of a conflict and only after the tax input credit that is available due to integrated tax has been fully utilized.

As per the Circular No: 98/17/2019 dated 23 April 2019, it has been clarified that-

According to the regulations in Section 49 of the CGST Act, the credit of integrated tax must be used first to pay of tax integrated, followed by central tax and finally State tax, if the ordeal, it is mandatory.

It led to a scenario where, in some cases, in which a tax payer has to pay his tax obligations for one kind of tax (say State tax) by using an electronic cash ledger, but the tax credit that is credited to inputs for other kinds that tax (say central tax) is not used in the digital credit ledger.

The recently added rule 88A of the CGST Rules allows utilisation of input tax credits of integrated tax for paying Central taxes and State tax or, as the situation could be, Union Territory tax, in any order, subject to the requirement that total tax credit for inputs on account of integrated tax is exhausted prior to the time that the tax credit for inputs for Central tax, State or Union Territories tax is able to be used.

It is clarified that, following the introduction of the rule, the sequence of the use of tax input credit will be based on the sequence (of numbers) as follows:

| Input tax credit on account of | Output liability on account of Integrated tax | Output liability on account of Central tax | Output liability on account of State tax |

|---|---|---|---|

| Integrated tax | (I) | (II) – In any order in any proportion | |

| (III) Input tax credit on account of Integrated tax to be completely exhausted mandatorily | |||

| Central tax | (V) | (IV) | Not permitted |

| State tax/Union Territory tax | (VII) | Not permitted | (VI) |

In the new regulations in place, it's required to make use of the complete IGST in the electronic credit ledger prior to using ITC for CGST as well as SGST. The sequence of setting off ITC of IGST is possible in any proportion, and any order can be used to set off CGST and SGST output following the same process for IGST output.

What is the maximum ITC that you can use for the payment of GST?

From January 1, 2021, certain taxpayers are not able to use the ITC balance that is available through the ledger of electronic credits in order to pay over 99% or more of tax owed for a particular tax period. That means that at least 1% of tax liability is payable in cash.

This applies to taxpayers who are able to claim the value of their taxable supplies in a month exceeding Rs.50 lakh (not being exempted or sero-rated supplies). These taxpayers can be exempt from this limitation:

- A registered taxpayer in which greater than Rs.1 lakh is paid in income tax over the last two years, in late IT returns for himself or his proprietor, or any two partners, trustee, managing director or board, etc.

- A tax payer who is registered and is able to claim greater than Rs.1 lakh as a refund of tax credits for inputs not used under GST due to sero-rated goods without paying tax or tax structure that is inverted.

- A taxpayer who was registered has who paid more than one percent of the GST liability he owes by using the electronic cash ledger for every tax period during the current fiscal year up to now.

- Government departments, PSU, local authorities, statutory bodies, etc.

For more information on the implications of Rule 86B, check out our article ' All about Rule 86B'.

How can The Tax Heaven assist in ITC Optimization?

The Tax Heaven GST software is designed to maximize ITC utilization. Through The Tax Heaven it is possible to be aware of what amount ITC that can be utilized for each tax categories - CGST SGST as well as UTGST. The Tax Heavenautomatically calculates the tax due for the quarter or month by first analyzing ITC of IGST prior to moving to CGST and SGST. The balance ITC that is that is available in CGST and SGST/UTGST should be allocated in a manner that will help you reap the maximum benefits. This ensures that your cash outflow is as low as that is possible.

Let's look at the implications of the New Rule with the help of an illustration: Assume the following scenario occurs: Mr. X has the following obligation and credit for input tax for the time period are as the following:

Let's examine ways in which we can make use of the ITC from IGST can be used in various ways, based on the two following scenarios:

Scenario 1: Setting-off of unused credit IGST to 100% towards CGST

Scenario 2: Set-off of unused credit for IGST partly to CGST as well as SGST liability, as optimized by The Tax Heaven

Scenario 2: Set-off of unused credit for IGST partly to CGST as well as SGST liability, as optimized by The Tax Heaven

*Note: In this example we have come up with just two scenarios, whereas the law does not impose any strict requirement of attributing the entire unutilised IGST credit to CGST or SGST liability. Taxpayers are able to use IGST credit in any amount and at any time however the requirement is to fully make use of the IGST credit prior to utilizing CGST or SGST credit. In the above example, The Tax Heaven helps optimize the ITC for you, and the amount to be paid was decreased.

*Note: In this example we have come up with just two scenarios, whereas the law does not impose any strict requirement of attributing the entire unutilised IGST credit to CGST or SGST liability. Taxpayers are able to use IGST credit in any amount and at any time however the requirement is to fully make use of the IGST credit prior to utilizing CGST or SGST credit. In the above example, The Tax Heaven helps optimize the ITC for you, and the amount to be paid was decreased.

The table below outlines the distinctions regarding the priority of ITC use with respect to the previous system as well as the new one.In accordance with the set-off rules of the past these are the priority order and order of ITC usage:

| Liability of → | IGST | CGST | SGST |

| ITC of↓ | |||

| IGST | 1 | 2 | 3 |

| CGST | 2 | 1 | Not permitted |

| SGST | 2 | Not permitted | 1 |

From the July 2019, the below off-set mode is now available. The next is the priority and order for ITC utilization.

| Liability of → | IGST | CGST | SGST |

| ITC of↓ | |||

| IGST | 1 | 2* | |

| CGST | 4 | 3 | Not permitted |

| SGST | 6 | Not permitted | 5 |

*The order in which the IGST credits post offsets to IGST liability may be in any order or proportion between CGST and SGST but the only condition is that you exhaust IGST completely before utilizing other credits. So in the table above for the new rules it can be concluded that taxpayers have to start the set-off process by using the ITC of IGST and then use it fully before attempting to use ITC of CGST or ITC of CGST or the ITC of SGST.

Illustrations on How GST Set-Off Works

Let's look at the applicability of the provisions by illustrating them with two examples.

Illustration 1: To comprehend the sequence of the IGST credit set-off

There is only a procedure change when using the IGST credit. To understand the concept of set-off from a practical standpoint let us consider an example. Let's say that Mr. X is a taxpayer with the following GST obligations as well as GST inputs.

(all figures in INR)

| Type of GST | Output Liability | Input Tax Credit |

| IGST | 500 | 2000 |

| CGST | 1000 | 150 |

| SGST/ UTGST | 1000 | 150 |

| Total | 2500 | 2300 |

As per the existing system, the set-off takes place as follows-

(all figures in INR)

| Type of Tax | Liability | Credit Available | Set-off of Liability | Balance to be paid in cash | Balance credit available | |

| IGST | 500 | 2,000 |

|

_ | _ | |

| CGST | 1,000 | 150 | 150 (from CGST) 850 (from IGST) | – | – | |

| SGST/ UTGST | 1,000 | 150 | 150 (from SGST) 650 (from IGST) | 200 | – |

It is evident the fact that CGST or SGST payable has to be paid first using CGST credit or SGST credit, respectively.

However, under the new set-off procedure the IGST credit will need to be set off and the following are three options for how this can be achieved:

Scenario 1: Take off unused credits of IGST to 100% towards CGST

(all figures in INR)

| Type of Tax | Liability | Credit Available | Set-off of Liability | Balance to be paid in cash | Balance credit available |

| IGST | 500 | 2,000 | 500 (from IGST) | _ | _ |

| CGST | 1,000 | 150 | 1000* (from IGST) | _ | 150 |

| SGST/ UTGST | 1,000 | 150 | 500 (from IGST) 150 (from SGST) | 350 | – |

Scenario 2: Set off of unutilised IGST credit completely towards SGST

(all figures in INR)

| Type of Tax | Liability | Credit Available | Set-off of Liability | Balance to be paid in cash | Balance credit available |

| IGST | 500 | 2,000 | 500 (from IGST) | _ | _ |

| CGST | 1,000 | 150 | 500 (from IGST) 150 (from CGST) | 350 | _ |

| SGST/ UTGST | 1,000 | 150 | 1000* (from IGST) | _ | 150 |

Scenario 3: Set-off of unutilised IGST credit partly towards CGST & SGST liability in an equal proportion

(all figures in INR)

| Type of Tax | Liability | Credit Available | Set-off of Liability | Balance to be paid in cash | Balance credit available |

| IGST | 500 | 2,000 | 500 (from IGST) | _ | _ |

| CGST | 1,000 | 150 | 750* (from IGST) 150 (from CGST) | 100 | _ |

| SGST/ UTGST | 1,000 | 150 | 750* (from IGST) 150 (From SGST) | 100 | _ |

Note:In this illustration, we have only three scenarios, while the law doesn't have a rigid rule for attributing all credit for IGST not utilized in the direction of CGST or SGST obligation.

A taxpayer is able to use IGST credits in any ratio or in any sequence but the only requirement is that they fully utilize the IGST credit prior to using CGST as well as SGST credit. In the example, in the above example, IGST credit has been utilized first under the new set-off system and only then will CGST or SGST/UTGST credit be set-off. In order to maximize credit usage, it is advised following Scenario 3.

Read Also:- Can you claim input tax credit on travel expenses?

Illustration II: better understand the the impact on business due to this new regulation

In the figure 1 we can see that the total GST output obligation was greater than the total GST input. We will see an example where the total GST input is greater than the total GST output. Imagine that Mr. X has the following obligation and credit for inputs during the tax period that follows-

(all figures in INR)

| Type of GST | Output Liability | Input Tax Credit |

| IGST | 500 | 1,000 |

| CGST | 500 | 300 |

| SGST/ UTGST | 500 | 300 |

| Total | 1,500 | 1,600 |

Let's see ways in which the ITC from IGST can be utilized in a variety of ways, based on the three following scenarios:

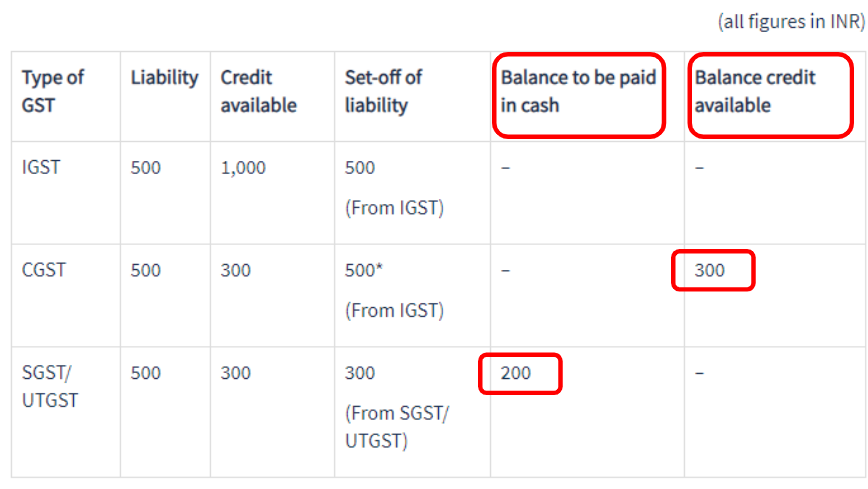

Scenario 1: Set off of unutilised IGST credit completely towards CGST

(all figures in INR)

| Type of GST | Liability | Credit available | Set-off of liability | Balance to be paid in cash | Balance credit available | |

| IGST | 500 | 1,000 |

|

– | – | |

| CGST | 500 | 300 | 500* (From IGST) | – | 300 | |

| SGST/ UTGST | 500 | 300 | 300 (From SGST/ UTGST) | 200 | – |

Scenario 2: Set off of unutilised IGST credit completely towards SGST

(all figures in INR)

| Type of GST | Liability | Credit available | Set-off of liability | Balance to be paid in cash | Balance credit available |

| IGST | 500 | 1,000 | 500 (From IGST) | – | – |

| CGST | 500 | 300 | 300 (From CGST) | 200 | – |

| SGST/ UTGST | 500 | 300 | 500* (From IGST) | – | 300 |

Scenario 3: Set-off of unutilised IGST credit partly towards CGST & SGST liability in an equal proportion

(all figures in INR)

| Type of GST | Liability | Credit available | Set-off of liability | Balance to be paid in cash | Balance credit available |

| IGST | 500 | 1,000 | 500 (From IGST) | – | – |

| CGST | 500 | 300 | 250* (From IGST) 250 (From CGST) | – | 50 |

| SGST/ UTGST | 500 | 300 | 250* (From IGST) 250 (From SGST) | – | 50 |

Note: In this illustration we came up with just three scenarios. The law doesn't impose any absolute rule that requires the attribution of all unutilized IGST credit entirely or entirely to CGST or SGST obligation.

A taxpayer is able to use IGST credit at any amount as well in any manner but the only requirement is that they use the IGST credit prior to making use of CGST or SGST credit. In the two cases above the taxpayer must make payment of or pay CGST or SGST or there's an unpaid amount in CGST credit, or SGST credit that is in Electronic Credit Ledger (ECL) or.

If the taxpayer is in the scenario 3 then there is no need to make the cash payment of the CGST or SGST tax and he may also carry forward a similar quantity that is equal to CGST and SGST in the ECL to ensure that, in subsequent months, if the purchase or sales pattern shifts from intra-state to interstate or vice versa, having an equal balance in the ledgers can help optimize the utilization of credit in the future years as well. This procedure must be monitored closely.

Updates on GST Portal

The validations that are based on modifications to the rule have been changed on the portal as of July 2019 from the date of.

Impact on Business

Let's talk about how this will affect your business. The new GST offset rules requires the full use of the IGST input credit prior making use of CGST or the SGST input credit. In the illustration 2, we can see that the taxpayer receives an increased credit because of transactions made in the state of origin as compared to intrastate purchases. Also, the sales are higher in the state when contrasted with outside the state. This leads to an accumulation of IGST input credits. In turn, if not used properly, it can result in a blocking for working capital.

If the taxpayer chooses to follow either of the scenarios 1 or 2 in Illustration II, the taxpayer is delay the respective CGST as well as SGST credit balance (as the situation is) to use for a number of tax periods. It causes a blockage in working capital for an extended amount of time.

Or, he could put off a date in which their interstate transactions (IGST obligation) exceeds his intrastate sales, to make use of the remaining credit from CGST or SGST that is carried forward. If the taxpayer chooses to follow scenario 3 and uses the credit available in equal amounts from CGST and SGST and SGST, he will be able to avoid the tax payment as well as the loss of working capital that may result. But from the perspective of the government this is a quick fix to enable a more efficient allocation to the beneficiaries of IGST revenue.

The takeaway: It is the GST Portal that lets taxpayers manually offset the tax on input credit against their output liability. It is suggested that taxpayers make the most efficient use of the ITC accessible to them through prudently distributing credits each tax year. The new off-set method doesn't result in an increase in working capital requirements as in comparison to the previous mechanism provided it is properly designed.

In the event of carrying forward credits, it is extremely recommended to create a balance and keep equal credit for each of the CGST as well as SGST/UTGST ledgers, for improving credits in the future. The most efficient way to do this is by using IGST credits to pay for your IGST liability, and the remaining credit is available in IGST credits can be utilized equally for CGST/SGST credits. If businesses missed performing this in the past two months, in the following month, they can optimize the process to achieve the same balance for both the CGST and SGST credit ledgers in the event there is an oversupply of ITC available, and carry on the same process for the rest of the year.