F-14/15, Orbit Mall, Civil Lines, Jaipur-302006

support@thetaxheaven.com

support@thetaxheaven.com

Bombay Burmah Trading Corporation Limited, established in 1863, stands as India's second-oldest publicly traded company and a flagship enterprise of the prestigious Wadia Group. With over 160 years of operational excellence spanning tea and coffee plantations, auto electrical components, healthcare products, and strategic investments in India's leading FMCG companies, BBTC represents a unique investment proposition combining heritage, diversification, and modern strategic positioning. In this comprehensive article, we analyze Bombay Burmah Trading Corporation's share price targets from 2025 to 2030, supported by detailed business analysis, financial performance metrics, and expert investment guidance.

Let's explore the company's diversified business ecosystem, current market valuation, and future growth trajectory to understand its long-term investment potential.

| Detail | Value |

|---|---|

| Current Price | ₹1,896.00 |

| Previous Close | ₹1,887.70 |

| Day's High | ₹2,088.00 |

| Day's Low | ₹1,896.00 |

| 52-Week High | ₹2,944.00 |

| 52-Week Low | ₹1,607.05 |

| Market Capitalization | ₹14,006 Cr |

| Beta (Volatility) | 1.21 |

| Book Value per Share | ₹731.82 |

| Face Value | ₹2 |

| All Time High | ₹2,975.00 |

| All Time Low | ₹6.12 |

| VWAP | ₹2,023.60 |

| Dividend Yield | 0.85% |

Originally incorporated in 1863 as The Bombay Burmah Trading Corporation to take over the Burmese assets and rights of William Wallace, the company initially focused on the teak timber business. Founded by six Wallace Brothers from Scotland who established Wallace Bros & Co in Bombay in 1848, the company was floated publicly in 1863, making it India's first rupee company with public participation and today stands as the country's second-oldest publicly quoted company.

Diverse Business Portfolio: BBTC operates through multiple business segments including Plantation-Tea, Auto Electric Components (marketed as Electromags), Healthcare (dental, orthopedic, and ophthalmic products), Food-Bakery & Dairy Products, Horticulture, analytical balances and weighing scales, and property development.

Strategic Investment in Britannia Industries: The crown jewel of BBTC's investment portfolio is its 50.5% controlling stake in Britannia Industries Limited, one of India's largest and most valuable FMCG companies with a market capitalization exceeding ₹1.45 lakh crore, representing the company's single most valuable asset.

Extensive Plantation Operations: The company manages 2,822 hectares of tea estates producing approximately 8 million kilograms annually, along with premium coffee cultivation across strategically located plantations in South India.

Wadia Group Legacy: As a flagship company of the renowned Wadia Group—which includes mastheads like Bombay Dyeing, Britannia, and BBTC—the company benefits from established brand equity, cross-business synergies, and over 160 years of business management expertise.

Remarkable Financial Turnaround: The company achieved an exceptional transformation from a ₹1,676 crore consolidated net loss in FY2023 to a ₹1,123 crore net profit in FY2025, demonstrating management's capability to navigate challenges and create shareholder value.

Outstanding Return Metrics: For FY2025, the company reported exceptional Return on Equity (ROE) of 42.87% and Return on Capital Employed (ROCE) of 46.17%, ranking among the highest in its peer group and reflecting superior capital efficiency.

Strong Balance Sheet Improvement: The debt-to-equity ratio improved dramatically from 1.62 in FY2023 to 0.27 in FY2025, indicating significant deleveraging and enhanced financial stability.

Consolidated Annual Turnover: The BBTC Group has an annual consolidated turnover of approximately USD 1.2 billion (approximately ₹18,300 crore), with consolidated revenues growing at an 8% CAGR over the past decade.

| Investor Type | Holding (%) |

|---|---|

| Promoters | 74.05% |

| Retail & Others | 15.19% |

| Foreign Institutions | 9.33% |

| Other Domestic Institutions | 1.04% |

| Mutual Funds | 0.39% |

The promoter holding of 74.05% demonstrates strong management commitment and long-term strategic vision under the Wadia Group's stewardship. However, the notably low institutional participation—with mutual funds holding merely 0.39% and total institutional holdings at 10.76%—suggests limited coverage by professional investors, potentially creating opportunity for valuation discovery as awareness increases.

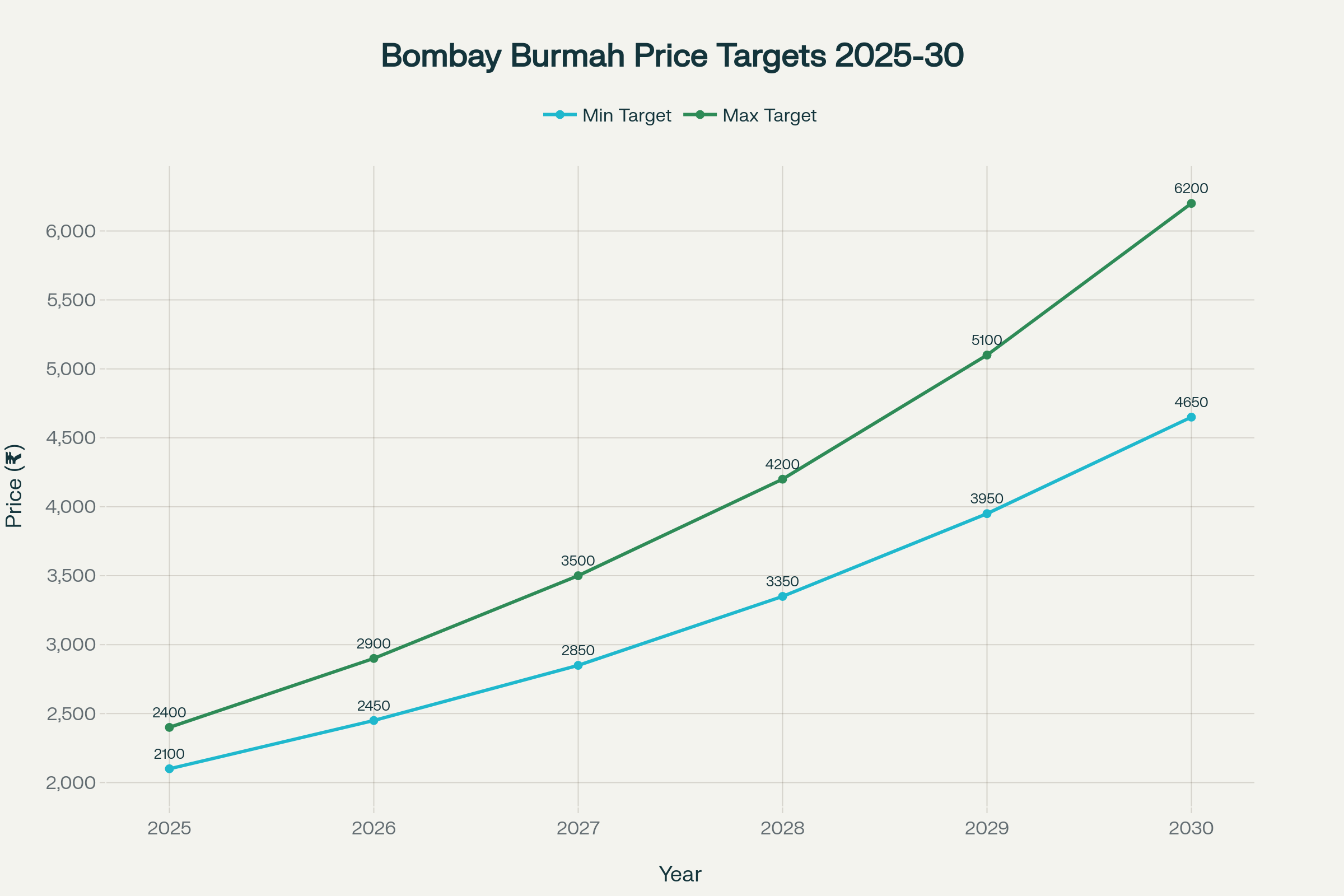

Projected share price targets for Bombay Burmah Trading Corporation Ltd from 2025 to 2030, showing conservative and optimistic estimates

| Year | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| 2025 | 2,100 | 2,400 |

| 2026 | 2,450 | 2,900 |

| 2027 | 2,850 | 3,500 |

| 2028 | 3,350 | 4,200 |

| 2029 | 3,950 | 5,100 |

| 2030 | 4,650 | 6,200 |

These projections are based on the substantial value of BBTC's 50.5% stake in Britannia Industries (currently valued at approximately ₹73,000+ crore), the company's exceptional ROE of 42.87% and ROCE of 46.17% demonstrating operational excellence, India's tea market projected to grow from USD 11.5 billion in 2024 to USD 15 billion by 2033 at 3.10% CAGR, and Britannia's strong growth trajectory with rural markets growing in double digits and urban markets in high single digits.

By the end of 2025, BBTC's share price is expected to witness moderate appreciation as the market begins recognizing the substantial value embedded in its Britannia stake and improving operational performance across business segments.

Why?

The company's 50.5% stake in Britannia Industries, with Britannia's market cap exceeding ₹1.45 lakh crore, alone represents a value of approximately ₹73,000+ crore, while BBTC's entire market cap is only ₹14,006 crore, suggesting significant undervaluation. Britannia reported strong Q1 FY2026 performance with revenue growth of 8.8% and is witnessing demand uptick across rural (double-digit growth) and urban markets (high single-digit growth), directly benefiting BBTC as majority shareholder. The company's Q1 FY2026 consolidated profit of ₹497.66 crore demonstrates sustained operational momentum following the remarkable FY2025 turnaround. India's premium tea segment is experiencing rapid growth, with sales reaching 15,000 metric tons in 2023, benefiting BBTC's quality tea plantations.

Investment Advice: This represents an attractive entry point for long-term value investors recognizing the Britannia stake discount. The stock is currently trading at approximately 2.35x price-to-book ratio despite exceptional ROE of 42.87%, indicating attractive valuation. Investors should consider systematic accumulation during corrections, particularly when the stock trades below ₹1,900. Monitor Britannia's quarterly performance closely as it directly impacts BBTC's asset value.

In 2026, the stock could experience stronger momentum as institutional investors and analysts increase coverage, leading to valuation re-rating based on sum-of-parts analysis highlighting the Britannia stake value.

Why?

Britannia's strategic initiatives to increase non-biscuit portfolio contribution to 35% of total revenue over five years should drive diversified growth and margin expansion, enhancing the value of BBTC's controlling stake. The Indian FMCG sector is witnessing structural growth with the packaged food market estimated at USD 100 billion, providing substantial runway for Britannia's expansion. BBTC's own operational businesses (tea, coffee, auto components, healthcare) are projected to contribute stronger cash flows as the company benefits from improved debt-to-equity ratio of 0.27 enabling investment in growth initiatives. The company's 5-year profit CAGR of 32.02% demonstrates strong earnings momentum that should continue with favorable industry tailwinds.

Investment Advice: Investors who entered during 2025 should continue holding and consider adding on dips. The stock's beta of 1.21 indicates slightly higher volatility than broader markets, creating tactical buying opportunities during market corrections. Evaluate the potential for dividend increases as BBTC's cash flows strengthen, though current dividend yield of 0.85% remains modest.

By 2027, BBTC could witness significant price appreciation as the market fully recognizes the embedded value in its Britannia stake and the company demonstrates consistent operational excellence across its diversified business portfolio.

Why?

India's tea industry is expected to reach INR 1.47 trillion by 2029, expanding at 6.98% CAGR during 2025-2030, with government initiatives like the Tea Development & Promotion Scheme (TDPS) fostering industry growth through modernization and enhanced competitiveness. Rising demand for organic and premium teas, with organic tea production reaching 1,375,000 metric tons in 2023, aligns perfectly with BBTC's quality plantation positioning. Britannia's market dominance—selling one in every three biscuits in India with unmatched rural penetration covering 9 out of 10 villages with over 1,000 people—provides stable earnings contribution to BBTC. The company's healthcare and auto components businesses should benefit from India's expanding manufacturing sector and rising healthcare infrastructure investments.

Investment Advice: Excellent holding for core portfolio allocation seeking exposure to India's consumption growth story through both FMCG (via Britannia) and plantation businesses. Long-term investors should maintain positions and reinvest dividends for compounding benefits. Monitor tea production trends and weather patterns impacting plantation operations, as these represent key operational risks.

By 2028, the stock could potentially cross ₹4,000 as the company establishes itself as a premium investment vehicle providing leveraged exposure to India's consumption growth through its Britannia stake while maintaining diversified operational businesses.

Why?

Britannia's continued market share gains in the Hindi belt (growing at 2.7 times other states) and successful product innovations (with 35% of croissant sales and 50% of Pure Magic star sales coming from e-commerce) should drive sustained earnings growth. India's tea consumption is expected to continue rising, with domestic consumption increasing by 10% YoY for wellness teas as health-conscious consumers drive demand for organic and specialty blends. The company's strategic initiatives in premium coffee production should gain traction, particularly in European and North American specialty markets seeking high-quality Indian coffee. BBTC's improved balance sheet with reduced debt burden enables potential expansion investments or strategic acquisitions to enhance growth profile.

Investment Advice: Suitable for long-term wealth creation portfolios. Investors should evaluate whether the market has fully priced in the Britannia stake value—if significant discount persists, the stock remains attractive. Consider the potential for corporate actions such as dividend increases, share buybacks, or partial monetization of investments as the company's cash position strengthens.

A strong market position through Britannia ownership combined with improving operational business performance makes BBTC an attractive long-term holding by 2029.

Why?

India's tea market approaching USD 15 billion by 2033 (growing at 3.10% CAGR) with increasing exports to Russia, Iran, and UAE creates sustained demand for BBTC's plantation products. Britannia's strategic expansion beyond biscuits into bread, dairy, cakes, and snacks—with the non-biscuit portfolio targeted to contribute 35% of revenue—provides diversified earnings streams benefiting BBTC as majority shareholder. The company's 160-year operational expertise and Wadia Group management should enable successful navigation of industry challenges including climate change impacts and labor cost inflation. Potential for increased institutional participation as analysts recognize the significant discount between BBTC's market cap and the value of its Britannia stake alone could drive valuation re-rating.

Investment Advice: Excellent vehicle for long-term investors seeking exposure to India's FMCG and plantation sectors through a single investment. Evaluate portfolio allocation based on individual risk tolerance—while the Britannia stake provides downside protection, the plantation business exposes investors to commodity price volatility and weather risks. Monitor succession planning and governance given the high promoter holding of 74.05%.

By 2030, Bombay Burmah Trading Corporation may establish itself as one of India's premier investment holding companies, potentially commanding valuations reflecting both its strategic Britannia stake and profitable operational businesses.

Why?

Britannia's potential to become a multi-category FMCG leader with total revenue exceeding ₹25,000+ crore (from current ₹18,000+ crore) and sustained market leadership across categories would significantly enhance BBTC's asset value. India's tea industry's projected value of INR 1.47 trillion by 2029-2030, combined with premium segment growth and export opportunities, positions BBTC's plantation business for sustained profitability. The company's track record of 14% stock price CAGR over 10 years, combined with improving operational metrics and deleveraged balance sheet, suggests continued shareholder value creation. Recognition of the "hidden value" in BBTC's structure—where the market cap significantly undervalues the Britannia stake alone—should drive sustained re-rating as awareness increases.

Investment Advice: At this stage, investors should evaluate the stock based on achieved fundamentals and market recognition of embedded value. If the historical discount between market cap and Britannia stake value persists, consider whether this represents structural inefficiency or reflects legitimate concerns about holding company discounts. Suitable for long-term wealth preservation and growth, particularly for investors comfortable with the unique characteristics of investment holding companies. Monitor potential corporate restructuring initiatives that could unlock shareholder value.

Yes, with awareness of unique characteristics. Bombay Burmah Trading Corporation presents a compelling long-term investment opportunity for investors seeking exposure to India's consumption growth story through both strategic investments (Britannia) and operational businesses (plantations, healthcare, auto components), though position sizing should reflect the company's holding company structure and specific risk factors.

Extraordinary Value Proposition: BBTC's 50.5% stake in Britannia Industries is currently valued at approximately ₹73,000+ crore (based on Britannia's ₹1.45 lakh crore market cap), while BBTC's entire market capitalization is only ₹14,006 crore, suggesting the market ascribes negative or minimal value to all other businesses—a significant pricing inefficiency.

Strong Financial Turnaround: The company's transformation from ₹1,676 crore consolidated loss in FY2023 to ₹1,123 crore profit in FY2025, with exceptional ROE of 42.87% and ROCE of 46.17%, demonstrates robust operational capabilities and management execution.

Britannia's Market Leadership: As majority owner of Britannia, BBTC benefits from India's largest biscuit company controlling one-third of the market, with unmatched distribution reaching 2.8 million retail outlets and penetration in 9 out of 10 villages with over 1,000 population.

Britannia's Growth Trajectory: Britannia reported strong Q1 FY2026 performance with revenue growth of 8.8%, double-digit rural growth, and strategic initiatives to expand non-biscuit categories to 35% of revenue over five years, directly benefiting BBTC shareholders.

Growing Tea Market: India's tea market valued at USD 11.5 billion in 2024 is projected to reach USD 15 billion by 2033 at 3.10% CAGR, with premium segment growing rapidly at 15,000 metric tons in 2023, supporting BBTC's plantation business valuation.

Government Support for Tea Industry: Initiatives like the Tea Development & Promotion Scheme (TDPS) running from 2023-24 to 2025-26 provide support for plantation development, quality upgradation, and market expansion, benefiting established players like BBTC.

Diversified Revenue Streams: The company's operations across tea, coffee, auto electrical components, healthcare products, weighing equipment, and horticulture provide revenue diversification and reduce dependence on any single business segment.

Strong Balance Sheet: Debt-to-equity ratio improvement from 1.62 to 0.27 indicates significant deleveraging, providing financial flexibility for growth investments and potential shareholder returns through dividends or buybacks.

Wadia Group Legacy: Over 160 years of operational excellence and association with the prestigious Wadia Group provides management credibility, strategic capabilities, and potential for value-unlocking corporate actions.

Attractive Valuation Metrics: Trading at P/E of 11.8x compared to FMCG sector median of 62.7x, and PEG ratio of 0.37 (well below 1.0 indicating undervaluation relative to growth), the stock offers value investment opportunity.

Holding Company Discount: Investment holding companies typically trade at discounts to net asset value (NAV) due to lack of control, potential tax liabilities on stake sale, and management fees, which may explain part of the current pricing gap.

Low Institutional Interest: Mutual fund holdings of only 0.39% and total institutional participation of 10.76% suggest limited professional investor interest, which could indicate concerns about liquidity, governance, or structural issues not immediately apparent.

Weather-Dependent Plantation Business: Tea production is significantly impacted by extreme weather events, with India's tea output dropping to 90.92 million kgs in May 2024 from 130.56 million kgs in May 2023 due to excessive heat and flooding, directly affecting BBTC's operational earnings.

Commodity Price Volatility: Tea prices expected to rise by up to 20% due to production disruptions create both opportunity (higher realization) and risk (demand destruction), introducing earnings volatility in the plantation segment.

Recent Stock Decline: The stock has fallen approximately 36% from its 52-week and all-time high of ₹2,975 to current levels around ₹1,896, indicating either market recognition of fundamental issues or temporary sentiment-driven correction requiring careful analysis.

Modest Dividend Yield: Current dividend yield of 0.85% is relatively low compared to peers, suggesting limited income generation for dividend-focused investors, though this could improve as cash flows strengthen.

High Promoter Concentration: Promoter holding of 74.05% limits float available for public investors, potentially constraining liquidity and making the stock susceptible to volatility during large trades.

Labor and Production Costs: Rising labor costs in plantation sector and ban on 20 pesticides requiring costly alternatives pressures margins, though this also creates barriers to entry for new competitors.

Poor Sales Growth: The company has delivered only 9.01% sales CAGR over the past five years and 8% over ten years, indicating modest top-line expansion in operational businesses excluding investment income.

Bombay Burmah Trading Corporation Limited represents one of India's most intriguing investment opportunities—a 162-year-old company with deep historical roots that has successfully transformed into a modern diversified conglomerate while maintaining controlling ownership of one of India's most valuable FMCG franchises, Britannia Industries.

Currently trading at approximately ₹1,896, the stock presents what appears to be a significant valuation anomaly: BBTC's 50.5% stake in Britannia Industries alone is worth approximately ₹73,000+ crore based on Britannia's market capitalization of ₹1.45 lakh crore, yet BBTC's entire market cap is only ₹14,006 crore. This implies the market assigns negative or minimal value to all other businesses—including profitable tea and coffee plantations producing 8 million kgs annually, established healthcare products division, auto electrical components manufacturing, and other assets.

The share price targets of ₹2,100-2,400 for 2025, scaling up to ₹4,650-6,200 by 2030, reflect the potential for market recognition of this embedded value through increased analyst coverage, institutional participation, and corporate actions that could unlock shareholder value. The company's remarkable financial turnaround from ₹1,676 crore loss in FY2023 to ₹1,123 crore profit in FY2025, with exceptional ROE of 42.87% and ROCE of 46.17%, demonstrates management's capability to create value across its operational businesses.

India's favorable industry trends support BBTC's growth outlook across multiple dimensions. The tea market is projected to grow from USD 11.5 billion in 2024 to USD 15 billion by 2033, with premium and organic segments experiencing accelerated growth. Britannia, BBTC's most valuable asset, is witnessing strong demand across both rural (double-digit growth) and urban markets (high single-digit growth), with strategic initiatives to expand its non-biscuit portfolio to 35% of revenue over five years providing diversified earnings streams.

For investors considering Bombay Burmah Trading Corporation, the key consideration is comfort with the holding company structure and patience for market recognition of embedded value. The stock is most suitable for long-term value investors who can look through short-term volatility (beta of 1.21) and modest dividend yields (0.85%) to appreciate the substantial asset value represented by the Britannia stake.

The low institutional participation—with mutual funds holding only 0.39%—suggests either limited awareness among professional investors or concerns about aspects such as holding company discounts, governance, or liquidity that warrant careful individual analysis. However, for investors who conduct thorough due diligence and conclude that the market is significantly undervaluing BBTC's assets, the current price levels may represent an attractive long-term entry point.

Conservative investors should monitor quarterly results from both BBTC and Britannia, track tea production and pricing trends, evaluate whether institutional participation increases over time, and watch for any corporate restructuring initiatives that could unlock value. Aggressive value investors might view the current ₹1,896 price—representing approximately 36% discount from the all-time high of ₹2,975—as an opportunity to accumulate positions in a company owning India's premier biscuit franchise while also operating profitable diversified businesses.

Stay updated with BBTC's quarterly financial results and annual reports, monitor Britannia's performance and strategic initiatives closely (as they directly impact majority of BBTC's asset value), track Indian tea industry developments and government support schemes, and follow any corporate announcements regarding dividend policy, share buybacks, or restructuring initiatives for optimal investment decision-making.

The immediate price target for Bombay Burmah Trading Corporation ranges between ₹2,100-2,400 for 2025, with medium-term targets of ₹2,850-3,500 by 2027 and long-term potential of ₹4,650-6,200 by 2030, based on the substantial value of its 50.5% Britannia stake and improving operational performance.

Bombay Burmah Trading Corporation represents a compelling value investment opportunity, particularly for investors who recognize that the company's ₹14,006 crore market cap is substantially below the ₹73,000+ crore value of just its Britannia stake alone. However, investors should understand the holding company structure and be comfortable with modest dividend yields and moderate liquidity.

The future outlook is positive based on Britannia Industries' strong growth trajectory (double-digit rural growth, expanding into new categories), India's tea market projected to reach USD 15 billion by 2033, the company's exceptional ROE of 42.87% and ROCE of 46.17%, and potential for market recognition of the significant discount between market cap and embedded asset value.

Analysts and market projections suggest a price target range of ₹2,100-2,400 for Bombay Burmah Trading Corporation by the end of 2025, reflecting partial re-rating as the market begins recognizing the value of the Britannia stake and improving operational performance across tea, coffee, and other business segments.

As of October 17, 2025, Bombay Burmah Trading Corporation share price is ₹1,896.00 on the NSE, with the stock trading near its previous close of ₹1,887.70. The 52-week range is ₹1,607.05 to ₹2,944.00, with the all-time high at ₹2,975.00, indicating the stock is currently trading about 36% below its peak.

The current price levels around ₹1,896 may represent an attractive entry point for long-term value investors, particularly considering the stock trades at significant discount to the embedded value of the Britannia stake alone. However, investors should research the reasons for the 36% decline from recent highs and ensure comfort with holding company structures before investing.

Investment in Bombay Burmah Trading Corporation is suitable for long-term value investors who appreciate the company's 50.5% controlling stake in Britannia Industries (India's largest biscuit company), understand holding company valuations, and are comfortable with the diversified business model spanning plantations, healthcare, and auto components. The stock offers leveraged exposure to India's consumption growth story.

Bombay Burmah Trading Corporation has increased approximately 18% from its 52-week low of ₹1,607.05 to the current price of around ₹1,896, though it remains about 36% below its 52-week and all-time high of ₹2,944-2,975, suggesting potential for recovery if fundamental value is recognized by the market.

You can invest in Bombay Burmah Trading Corporation by opening a demat and trading account with a registered stockbroker, completing KYC requirements, funding your account, and purchasing shares through NSE or BSE where the stock is listed under the symbol BBTC.

As of October 2025, Bombay Burmah Trading Corporation's shareholding pattern shows Promoters (Wadia Group) holding 74.05%, Retail and Others holding 15.19%, Foreign Institutions holding 9.33%, Other Domestic Institutions holding 1.04%, and Mutual Funds holding only 0.39%, indicating strong promoter control but very limited institutional participation.

Disclaimer: This article is for educational and informational purposes only and should not be construed as financial advice or investment recommendation. Investment in equity markets involves substantial risk of capital loss. The share price targets mentioned are projections based on current information, market analysis, and assumptions about future performance of Bombay Burmah Trading Corporation, Britannia Industries, and industry trends, all of which may change materially due to various factors including economic conditions, regulatory changes, weather events affecting plantations, competitive dynamics, and company-specific developments. The valuation analysis regarding the Britannia stake represents the author's interpretation and may not reflect actual realizable value due to holding company discounts, tax considerations, or other structural factors. Past financial performance, including the strong recovery from FY2023 losses, does not guarantee similar future results. The plantation business is subject to weather risks, commodity price volatility, and climate change impacts that could materially affect earnings. Readers are strongly advised to conduct their own thorough due diligence, review official company filings and financial statements from both BBTC and Britannia Industries, understand the unique characteristics and risks of investment holding companies, and consult with qualified and certified financial advisors before making any investment decisions. The author and publisher assume no liability or responsibility for any financial losses, damages, or adverse consequences incurred based on information, analysis, or projections presented in this article.