F-14/15, Orbit Mall, Civil Lines, Jaipur-302006

support@thetaxheaven.com

support@thetaxheaven.com

Artemis Medicare Services Limited, established in 2007 by the promoters of the $4 billion Apollo Tyres Group, has emerged as one of North India's premier multi-specialty healthcare providers. Operating a state-of-the-art 750+ bed super-specialty hospital in Gurgaon with JCI and NABH accreditation, Artemis represents the gold standard in Indian private healthcare delivery. In this comprehensive article, we analyze Artemis Medicare Services' share price targets from 2025 to 2030, supported by detailed business analysis, financial performance metrics, and expert investment guidance.

Let's explore the company's healthcare ecosystem, current market positioning, and future growth trajectory to understand its long-term investment potential.

| Detail | Value |

|---|---|

| Current Price | ₹239.90 |

| Previous Close | ₹239.99 |

| Day's High | ₹245.00 |

| Day's Low | ₹238.32 |

| 52-Week High | ₹350.00 |

| 52-Week Low | ₹207.71 |

| Market Capitalization | ₹3,366 Cr |

| Beta (Volatility) | 0.91 |

| Book Value per Share | ₹57.05 |

| Face Value | ₹1 |

| All Time High | ₹350.00 |

| All Time Low | ₹13.50 |

| VWAP | ₹241.72 |

| Dividend Yield | 0.19% |

Originally incorporated in February 2004, Artemis Medicare Services Limited was established as a healthcare venture by the promoters of the Apollo Tyres Group to capitalize on India's burgeoning demand for world-class healthcare services. Artemis Hospital, established in 2007 and spread across 9 acres in Gurgaon, operates as a 750+ bed state-of-the-art multi-specialty hospital and stands as the first JCI and NABH accredited hospital in Gurgaon.

Premier Healthcare Facility: Artemis operates one of India's most advanced hospitals with comprehensive infrastructure including 40+ specialties, 400+ full-time doctors, 12 Centres of Excellence, and cutting-edge medical technology including the groundbreaking M6 CyberKnife system and da Vinci Robotic Surgical system.

Centres of Excellence: The hospital's specialized centers include Artemis Heart Centre, Cancer Centre, Neurosciences Centre, Joint Replacement & Orthopaedics Centre, Organ Transplant Centre, Women & Child Centre, Emergency & Trauma Centre, Minimally Invasive & Bariatric Surgery Centre, Gastrosciences Centre, and Critical Care & Pulmonology Centre.

Exceptional Financial Turnaround: The company reported consolidated net profit of ₹822 million in FY2025, representing a remarkable 67.5% year-over-year growth from ₹491 million in FY2024, demonstrating strong operational momentum and improving profitability.

Strong Recent Performance: Q1 FY2026 results showcased robust performance with consolidated gross revenue of ₹2,681 million (up 14.4% YoY), net revenue of ₹2,550 million (up 14.2% YoY), EBITDA of ₹483 million (up 19.0% YoY), and net profit of ₹212 million (up 28.2% YoY).

Strategic Expansion Funding: The company raised ₹330 crore from International Finance Corporation (IFC) in FY2025 to fuel strategic expansion across Delhi NCR and select Tier-2 cities through both brownfield and greenfield projects.

Medical Tourism Leader: Artemis has established itself as a preferred destination for international patients, with overseas patient revenues increasing by 31.4% to ₹704 million in Q1 FY2026 and contributing 29% of net revenue, demonstrating strong global appeal.

Premium Revenue Realization: The hospital's average revenue per occupied bed (ARPOB) reached ₹83,900 in Q1 FY2026, the highest in its history, up from ₹79,200 in Q1 FY2025, indicating successful premiumization and case-mix improvement.

Capacity Expansion: The company inaugurated its third tower during FY2025 which will be commissioned in a phased manner, with plans to expand from current 750+ beds to 850-1,000 beds by 2025, addressing increasing demand from growing patient base.

Diversified Healthcare Portfolio: Beyond its flagship Gurgaon facility, Artemis operates Artemis Lite Multi-Specialty Hospitals in NFC Delhi and 82A Gurgaon, and Daffodils by Artemis luxury women and child hospitals in Gurugram and EOK Delhi, providing comprehensive healthcare across segments.

Consistent Growth Trajectory: The company has demonstrated strong 5-year profit CAGR of 32.5%, 3-year profit CAGR of 36.83%, and 3-year revenue CAGR of 18.79%, reflecting sustained business momentum.

| Investor Type | Holding (%) |

|---|---|

| Promoters | 66.53% |

| Retail & Others | 28.83% |

| Other Domestic Institutions | 2.26% |

| Mutual Funds | 2.01% |

| Foreign Institutions | 0.37% |

The promoter holding of 66.53% demonstrates strong management commitment and long-term strategic vision under the Apollo Tyres Group's stewardship. However, investors should note that 44.5% of promoter shares are pledged or encumbered, representing a risk factor requiring monitoring. The relatively modest institutional participation at 4.65% (combined domestic institutions, mutual funds, and foreign institutions) suggests potential for increased professional investor interest as the company continues delivering strong growth.

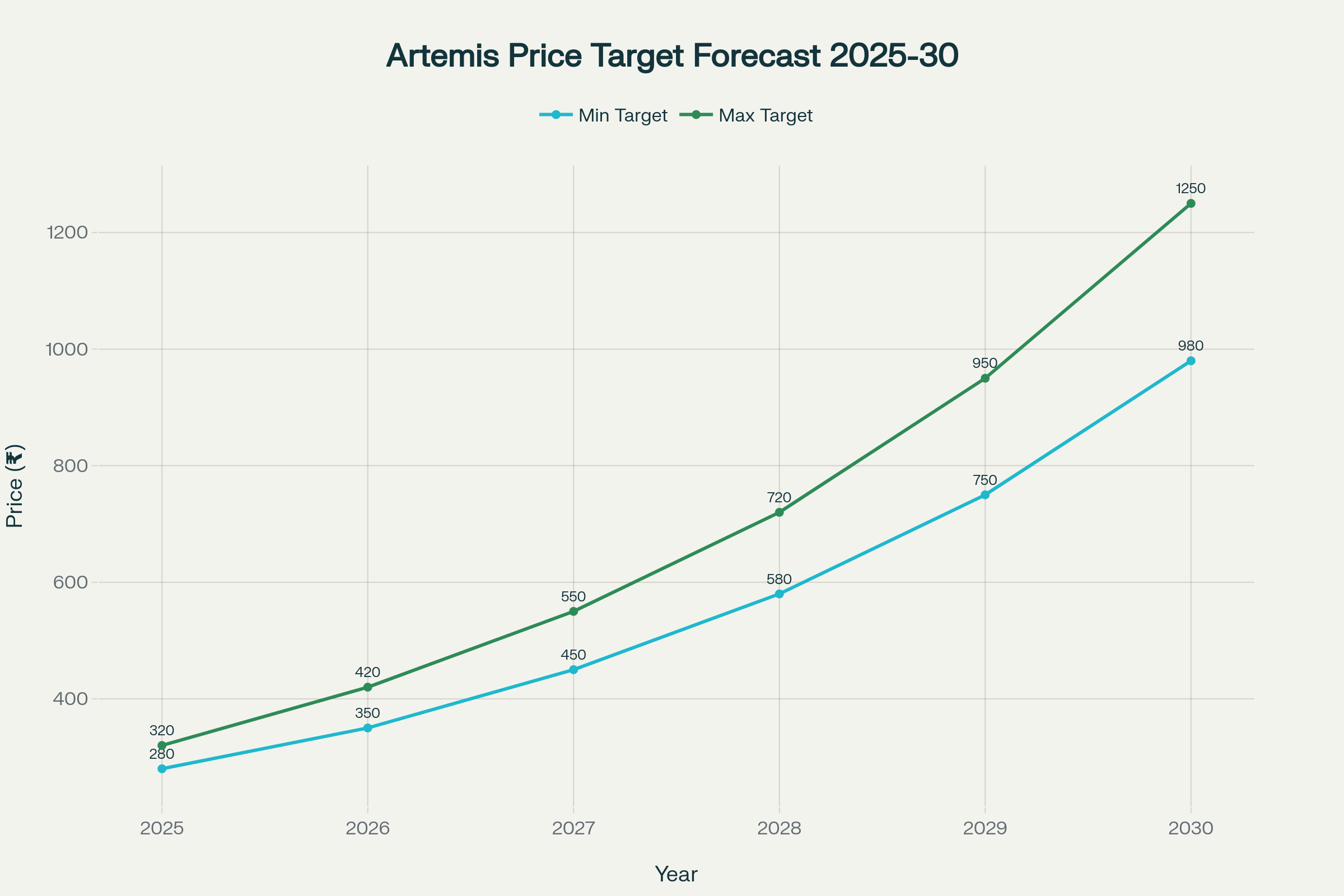

Projected share price targets for Artemis Medicare Services Ltd from 2025 to 2030, showing conservative and optimistic estimates

| Year | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| 2025 | 280 | 320 |

| 2026 | 350 | 420 |

| 2027 | 450 | 550 |

| 2028 | 580 | 720 |

| 2029 | 750 | 950 |

| 2030 | 980 | 1,250 |

These projections are based on analyst forecasts of 24.8% annual earnings growth and 18% annual revenue growth over the next three years, strong Q1 FY2026 performance with 28.2% net profit growth demonstrating operational momentum, ₹330 crore IFC funding enabling strategic expansion across Delhi NCR and Tier-2 cities, and India's healthcare market projected to reach $1.5 trillion by 2030 growing at 19% annually.

By the end of 2025, Artemis Medicare Services' share price is expected to witness moderate appreciation as the company deploys its recent IFC funding and commissions additional capacity from its third tower.

Why?

The company's Q1 FY2026 performance with 28.2% net profit growth and 14.2% revenue growth demonstrates strong operational momentum that should continue through the year. The phased commissioning of the third tower will add meaningful capacity to accommodate growing demand, with the company targeting 850-1,000 beds by 2025 from current 750+ beds. Overseas patient revenues growing at 31.4% and contributing 29% of net revenue highlight Artemis's successful penetration of the lucrative medical tourism segment, which is expected to reach $8.71 billion in India by 2025. EBITDA margins improved to 21.4% in Q4 FY2025 and 20.5% in Q1 FY2026, suggesting operational efficiency gains and economies of scale.

Investment Advice: This represents an attractive entry point for long-term healthcare sector investors. The stock is currently trading at approximately 31% below its 52-week and all-time high of ₹350, potentially offering value for patient investors. Consider systematic accumulation during corrections, particularly when the stock trades below ₹240. Monitor quarterly bed occupancy rates and ARPOB trends as key operational metrics.

In 2026, the stock could experience stronger momentum as the full-year impact of capacity expansion becomes visible and the company demonstrates sustained profitability improvement.

Why?

Analysts forecast Artemis's revenue to reach approximately ₹10,709 million in FY2026 and earnings of ₹1,003 million, representing substantial growth from FY2025's ₹9,369 million revenue and ₹826 million earnings. India's private hospital sector is adding over 4,000 beds in FY2025-26 with investment of ₹11,500 crore, indicating robust industry growth that benefits established players like Artemis. The company's strategic expansion plans funded by the ₹330 crore IFC investment should start materializing, with new facilities in Delhi NCR and select Tier-2 cities beginning operations. Medical tourism to India is projected to reach $8.71 billion in 2025 growing at 14-15% CAGR, directly benefiting Artemis which derives nearly 30% of revenues from international patients.

Investment Advice: Ideal accumulation phase for medium to long-term investors seeking exposure to India's private healthcare growth story. Evaluate the company's success in ramping up the third tower capacity and achieving targeted bed occupancy rates. Monitor competitive positioning against other premium hospitals in NCR including Max Healthcare, Fortis, and Medanta.

By 2027, Artemis could witness significant price appreciation as it establishes itself as a mature multi-location healthcare provider with demonstrated expansion execution capabilities.

Why?

Analysts forecast revenue reaching ₹12,910 million and earnings of ₹1,273 million by FY2027, representing continued strong growth trajectory. India's healthcare market valued at approximately $180 billion in 2024 is projected to grow at 18-20% CAGR, reaching substantial scale by 2027 driven by rising incomes, wider insurance penetration, and digital transformation. The company's planned expansion into Tier-2 cities should contribute meaningfully to revenues, capitalizing on the trend where 38-40% of new hospital capacity (approximately 14,000 beds) is targeted toward Tier-2 and Tier-3 cities by FY2029. Artemis's superior ARPOB of ₹83,900 (highest in company history) demonstrates pricing power and favorable case-mix, positioning the company to benefit from growing demand for tertiary and quaternary care.

Investment Advice: Excellent holding for core healthcare portfolio allocation. Long-term investors who entered during 2025-2026 should maintain positions and consider adding during market corrections. Evaluate the company's return on invested capital from expansion projects to assess management's capital allocation effectiveness.

By 2028, the stock could potentially approach ₹700 as the company matures into a leading multi-city hospital chain with strong brand recognition and operational excellence.

Why?

Analysts project revenue of approximately ₹15,872 million and earnings of ₹1,737 million by FY2028, representing substantial scale achievement. India's healthcare sector is expected to surpass $1.5 trillion by 2030, implying the market would be approaching this milestone by 2028 with continued 19% annual growth. The private hospital sector is adding 34,000 new beds by FY2029 with ₹40,000 crore investment, and Artemis's strategic positioning in this expansion should drive market share gains. Medical tourism to India projected to reach $16.21 billion by 2030 suggests the market would exceed $12-13 billion by 2028, benefiting Artemis which has established strong international patient credentials.

Investment Advice: Suitable for long-term wealth creation portfolios. Investors should evaluate whether Artemis has successfully integrated new facilities and maintained quality standards across multiple locations. Monitor ROCE and ROE metrics to ensure profitable growth rather than just revenue expansion. The company's target ROE of 13% by FY2028 provides a benchmark for assessing performance.

A strong market position in Delhi-NCR and expanding presence in Tier-2 cities makes Artemis an attractive long-term holding by 2029.

Why?

Continued 18-20% healthcare market growth driven by India's demographic trends including rising life expectancy to 84 years by 2045 and median age increasing from 28.8 to 38.3 by 2050 creates sustained demand. The company's established Centres of Excellence in cardiology, oncology, neurosciences, and transplants should drive specialized tertiary care revenues with premium pricing power. India's hospital services market projected to reach approximately ₹199,140.7 million ($199 billion) by 2030 at 7% CAGR suggests strong industry fundamentals supporting revenue growth for established players. Artemis's Apollo Tyres Group backing provides strategic advantages including access to capital, management expertise, and cross-business synergies.

Investment Advice: Excellent vehicle for long-term investors seeking exposure to India's healthcare sector through a quality asset with strong fundamentals. Consider partial profit booking if valuations become stretched relative to earnings growth. Monitor the company's dividend policy evolution as cash flows strengthen, though current yield of 0.19% remains minimal.

By 2030, Artemis Medicare Services may establish itself as one of India's leading private hospital chains, potentially commanding premium valuations based on demonstrated multi-year growth and operational excellence.

Why?

India's healthcare market approaching $1.5 trillion by 2030 with continued strong growth provides substantial runway for established players to scale operations. Medical tourism to India projected to reach $16.21-18 billion by 2030 at 13-14% CAGR positions Artemis, which already derives 30% revenues from international patients, to capture significant share. The company's expansion from a single 750-bed facility in 2025 to a multi-location chain with 1,000+ beds across NCR and Tier-2 cities represents substantial operational scale achievement. Private hospitals in India adding 34,000 beds by FY2029 with ₹40,000 crore investment indicates consolidation opportunities where well-capitalized players like Artemis can gain market share.

Investment Advice: At this stage, investors should evaluate the stock based on achieved fundamentals including revenue scale, profitability margins, return ratios, and market position rather than growth projections. Assess whether the company has successfully executed its expansion strategy while maintaining quality standards and financial discipline. Suitable for long-term wealth preservation and growth if Artemis has delivered on its strategic roadmap over the preceding five years.

Qualified Yes. Artemis Medicare Services presents a compelling long-term investment opportunity for investors seeking exposure to India's rapidly expanding private healthcare sector, though position sizing should reflect the company's growth stage characteristics and specific risk factors.

Massive Market Opportunity: India's healthcare market valued at approximately $180 billion in 2024 is projected to reach $1.5 trillion by 2030, growing at 18-20% annually, providing substantial runway for established hospital chains to scale operations.

Strong Growth Momentum: Analysts forecast Artemis's earnings to grow at 24.8% annually and revenue at 18% annually over the next three years, significantly outpacing India's overall market growth of 16% and savings rate of 6.8%.

Impressive Recent Performance: Q1 FY2026 results with 28.2% net profit growth, 14.2% revenue growth, and 19.0% EBITDA growth demonstrate strong operational execution and improving profitability trajectory.

Strategic Expansion Funding: The ₹330 crore raised from International Finance Corporation provides capital for strategic expansion across Delhi NCR and Tier-2 cities without immediate dilution pressure, positioning the company for accelerated growth.

Medical Tourism Leader: With 31.4% growth in overseas patient revenues and 29% contribution to total revenue, Artemis is well-positioned to benefit from India's medical tourism market projected to reach $16-18 billion by 2030 from $7.69 billion in 2024.

Premium Positioning: Record-high ARPOB of ₹83,900 demonstrates successful premium positioning and favorable case-mix, with the ability to command pricing power in tertiary and quaternary care segments.

World-Class Infrastructure: As the first JCI and NABH accredited hospital in Gurgaon with cutting-edge technology including M6 CyberKnife and da Vinci Robotic systems, Artemis maintains competitive advantages in medical technology and quality.

Strong Promoter Background: Backing from the $4 billion Apollo Tyres Group provides strategic advantages including financial strength, management expertise, and business credibility.

Capacity Expansion Visibility: Clear capacity expansion roadmap from 750+ beds currently to 850-1,000 beds by 2025, with further expansion planned across NCR and Tier-2 cities, provides revenue growth visibility.

Consistent Historical Performance: 5-year profit CAGR of 32.5%, 3-year profit CAGR of 36.83%, and 3-year revenue CAGR of 18.79% demonstrate sustained business momentum and execution capabilities.

High Promoter Pledge: Approximately 44.5% of promoter shareholding is pledged or encumbered, which could create governance concerns or forced selling pressure during market downturns requiring careful monitoring.

Low Institutional Interest: Mutual fund holdings of only 2.01% and total institutional participation of 4.65% suggest limited professional investor interest, potentially constraining liquidity and valuation support.

Recent Stock Decline: The stock has fallen approximately 31% from its 52-week and all-time high of ₹350 to current levels around ₹240, indicating either market recognition of challenges or temporary sentiment-driven correction requiring analysis.

Low Return on Equity: The company's 3-year average ROE of 11.7% is considered low, though improving to 12.9% in recent periods, suggesting room for enhancement in capital efficiency.

Modest Dividend Yield: Current dividend yield of 0.19% provides minimal income for dividend-focused investors, though this is typical for growth-stage healthcare companies reinvesting in expansion.

Valuation Concerns: Trading at 3.92 times book value and P/E of 37.9x represents premium valuation that requires sustained growth delivery to justify, leaving limited margin of safety during market corrections.

Execution Risk: Successful deployment of ₹330 crore IFC funding and execution of expansion into new locations (Tier-2 cities, NCR expansion) carries inherent execution risk and requires proven multi-location management capabilities.

Competitive Intensity: Operating in highly competitive Delhi-NCR market against established players like Max Healthcare (₹1.14 lakh crore market cap), Apollo Hospitals (₹1.13 lakh crore), and Fortis (₹83,000 crore) requires continuous differentiation and quality maintenance.

Regulatory and Reimbursement Risks: Healthcare sector faces evolving regulations, potential price caps on procedures, and changing insurance reimbursement policies that could impact profitability.

Capital Intensive Growth: Hospital expansion requires substantial capital investment with long gestation periods before achieving target occupancy and profitability, straining balance sheet metrics during growth phase.

Artemis Medicare Services Limited stands at an exciting inflection point in its corporate evolution. Having successfully established itself as North India's premier multi-specialty hospital with JCI and NABH accreditation, world-class medical technology, and strong brand recognition, the company is now embarking on an ambitious expansion phase backed by ₹330 crore from the International Finance Corporation.

Currently trading at approximately ₹240, the stock presents an intriguing investment proposition for long-term healthcare sector investors. The company's recent operational performance has been exceptional—Q1 FY2026 net profit grew 28.2%, revenue increased 14.2%, and EBITDA expanded 19.0%, with the flagship Gurgaon hospital achieving record-high ARPOB of ₹83,900. These metrics demonstrate strong operational leverage and improving profitability as the business scales.

The share price targets of ₹280-320 for 2025, scaling up to ₹980-1,250 by 2030, reflect the company's substantial growth potential if it successfully executes its strategic priorities: effective deployment of IFC funding toward capacity expansion, successful ramping up of the third tower and achievement of 850-1,000 bed capacity, execution of expansion into Delhi NCR and Tier-2 cities, and maintenance of premium positioning with ARPOB growth and favorable case-mix.

India's healthcare sector provides exceptionally favorable tailwinds for Artemis's growth ambitions. The market is projected to grow from approximately $180 billion in 2024 to $1.5 trillion by 2030 at 18-20% CAGR, driven by rising incomes, aging demographics, wider insurance penetration, and digital transformation. Medical tourism, where Artemis has established strong credentials with 30% of revenues from international patients, is expected to nearly double from $7.69 billion in 2024 to $16-18 billion by 2030.

The private hospital sector is undergoing unprecedented expansion, with leading chains adding 34,000 new beds by FY2029 requiring ₹40,000 crore investment, and 38-40% of this capacity targeted toward Tier-2 and Tier-3 cities where Artemis plans strategic expansion. This industry consolidation and geographic expansion trend aligns perfectly with Artemis's strategy and provides validation of management's growth plans.

For investors considering Artemis Medicare Services, the key considerations are risk tolerance, investment horizon, and conviction in India's healthcare growth story. The stock is most suitable for long-term investors seeking exposure to private healthcare through a quality asset with proven operational excellence, strong promoter backing, and clear expansion plans. The high promoter pledge of 44.5% and low institutional participation of 4.65% warrant monitoring, but the company's strong fundamentals and growth prospects provide compelling offsetting factors.

Conservative investors should wait for at least two to three quarters of sustained performance post-expansion to assess execution capabilities before building significant positions. Aggressive growth-oriented investors can consider systematic accumulation through SIPs, capitalizing on the stock's 31% correction from highs and positioning for potential multi-year appreciation as expansion plans materialize.

Stay updated with quarterly financial results and capacity utilization metrics, monitor deployment of IFC funds and new facility launches, track medical tourism trends and international patient contribution, and evaluate competitive positioning in key markets for optimal investment decision-making.

The immediate price target for Artemis Medicare Services ranges between ₹280-320 for 2025, with medium-term targets of ₹450-550 by 2027 and long-term potential of ₹980-1,250 by 2030, based on strong earnings growth forecasts of 24.8% annually and revenue growth of 18% annually.

Artemis Medicare Services represents a promising long-term investment in India's expanding healthcare sector, particularly suitable for investors seeking exposure to premium hospital chains. The stock's 31% decline from its all-time high of ₹350 to current ₹240 may offer value entry, though the high promoter pledge of 44.5% requires monitoring.

The future outlook is positive based on India's healthcare market projected to reach $1.5 trillion by 2030, strong Q1 FY2026 performance with 28.2% net profit growth, ₹330 crore IFC funding for strategic expansion, and medical tourism growing at 14-15% annually benefiting Artemis's 30% international patient revenue contribution.

Analysts and market projections suggest a price target range of ₹280-320 for Artemis Medicare Services by the end of 2025, reflecting capacity expansion from the third tower, deployment of IFC funding, and continued strong operational performance demonstrated in Q1 FY2026 results.

As of October 17, 2025, Artemis Medicare Services share price is ₹239.90 on the NSE, trading near its previous close of ₹239.99. The 52-week range is ₹207.71 to ₹350.00, which also represents the all-time high, indicating the stock is currently about 31% below its peak.

The current period may offer a reasonable entry point for long-term investors, with the stock trading 31% below its all-time high while fundamentals remain strong—Q1 FY2026 showed 28.2% net profit growth and analysts forecast 24.8% annual earnings growth. Systematic accumulation during corrections below ₹240 may provide attractive average prices.

Investment in Artemis Medicare Services should be based on long investment horizon, conviction in India's healthcare sector growth story (projected $1.5 trillion market by 2030), and comfort with growth-stage company characteristics. The stock suits moderate allocation in diversified portfolios focused on healthcare, though the 44.5% promoter pledge requires monitoring.

Artemis Medicare Services has increased approximately 15.5% from its 52-week low of ₹207.71 to the current price of around ₹240, though it remains about 31% below its 52-week and all-time high of ₹350.00, suggesting potential for recovery if operational momentum continues.

You can invest in Artemis Medicare Services by opening a demat and trading account with a registered stockbroker, completing KYC requirements, funding your account, and purchasing shares through NSE or BSE where the stock is listed under the symbol ARTEMISMED.

As of October 2025, Artemis Medicare Services' shareholding pattern shows Promoters holding 66.53%, Retail and Others holding 28.83%, Other Domestic Institutions holding 2.26%, Mutual Funds holding 2.01%, and Foreign Institutions holding 0.37%, with notably 44.5% of promoter shares pledged or encumbered.

Disclaimer: This article is for educational and informational purposes only and should not be construed as financial advice or investment recommendation. Investment in equity markets involves substantial risk of capital loss. The share price targets mentioned are projections based on current information, analyst forecasts, market trends, and assumptions about future performance of Artemis Medicare Services and the Indian healthcare sector, all of which may change materially due to various factors including economic conditions, regulatory changes, competitive dynamics, execution challenges, and company-specific developments. The analyst earnings and revenue growth forecasts cited represent third-party estimates that may not materialize. Past financial performance, including the strong profit growth rates mentioned, does not guarantee similar future results. The healthcare sector is subject to regulatory risks, reimbursement policy changes, competition from established players, and execution risks inherent in capacity expansion projects. The high promoter pledge of 44.5% represents a significant risk factor requiring careful consideration. Readers are strongly advised to conduct their own thorough due diligence, review official company filings and financial statements, understand the specific risks associated with healthcare sector investments and growth-stage companies, and consult with qualified and certified financial advisors before making any investment decisions. The author and publisher assume no liability or responsibility for any financial losses, damages, or adverse consequences incurred based on information, analysis, or projections presented in this article.